Mergers and acquisitions (M&A) are common occurrences in the business world. While many people talk about mergers and acquisitions interchangeably, it is important to know that each transaction has its own nuances and defining factors. Understanding these differences is crucial for handling the transaction(s) correctly to ensure your organization remains in compliance.

While the decision to undertake a transaction such as this is a high-level business decision, the transaction itself can have implications spanning across your organization. Each department, from HR to payroll to operations, will feel the effects, and it’s essential to be prepared to navigate these changes effectively to minimize potential impact.

Thomas & Company’s M&A Mondays will explore the impact M&A activity can have on your organization, highlighting key considerations that should be taken into account when M&A activity occurs in the following areas:

- Multi-State Compliance

- Employment and Wage Verification

- Unemployment Cost Management

- Tax Credits & Incentives

- Offboarding Compliance (State Separation Notices)

- I-9

But first, it is important to understand what exactly is meant by merger and acquisition activity and the nuances associated with these activities.

Types of Activities

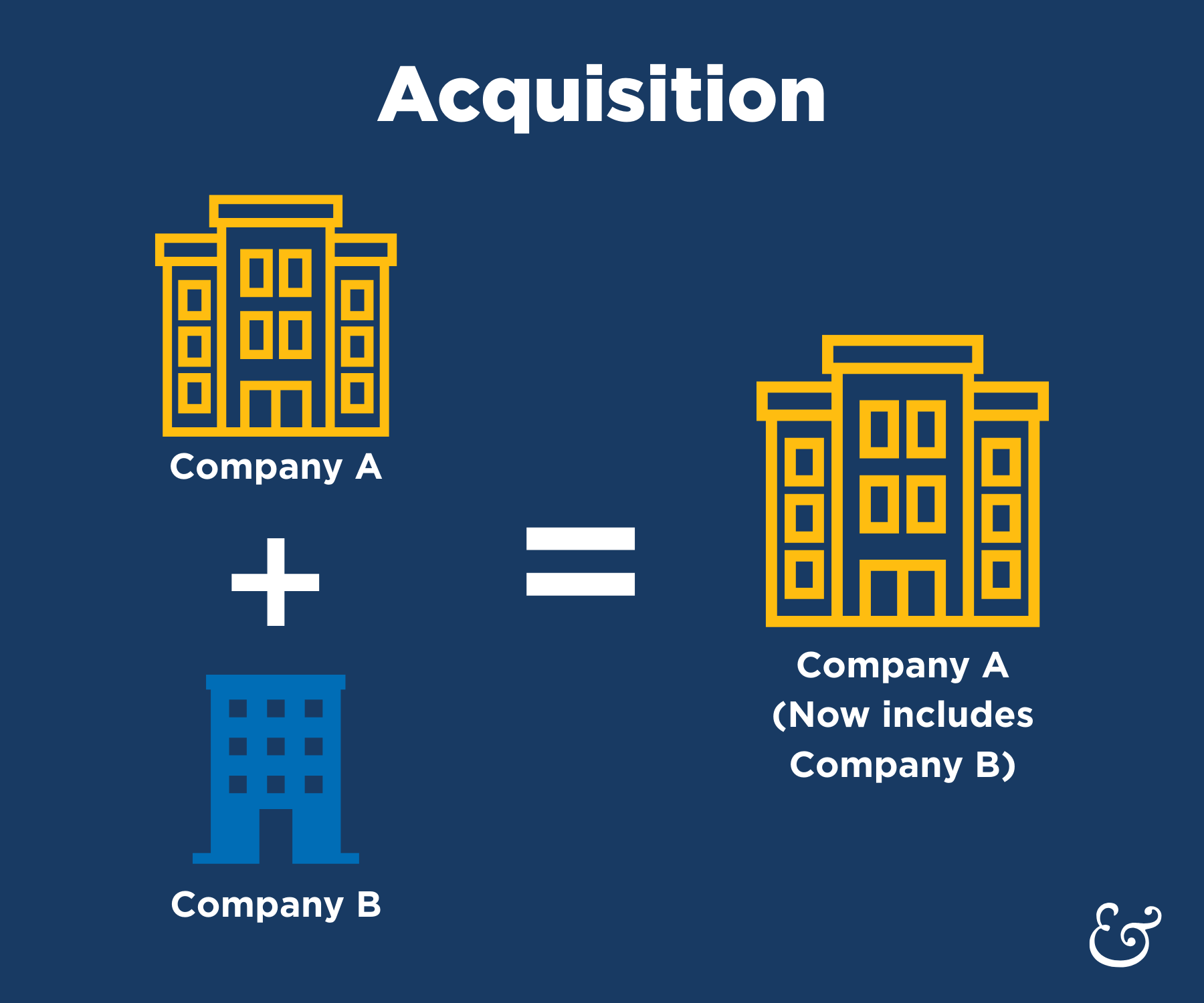

Acquisition

An acquisition occurs when one company purchases another, obtaining control over its operations, assets, and management. The acquired company may either be absorbed entirely, or it may continue to operate as a subsidiary under the direction of the acquiring company.

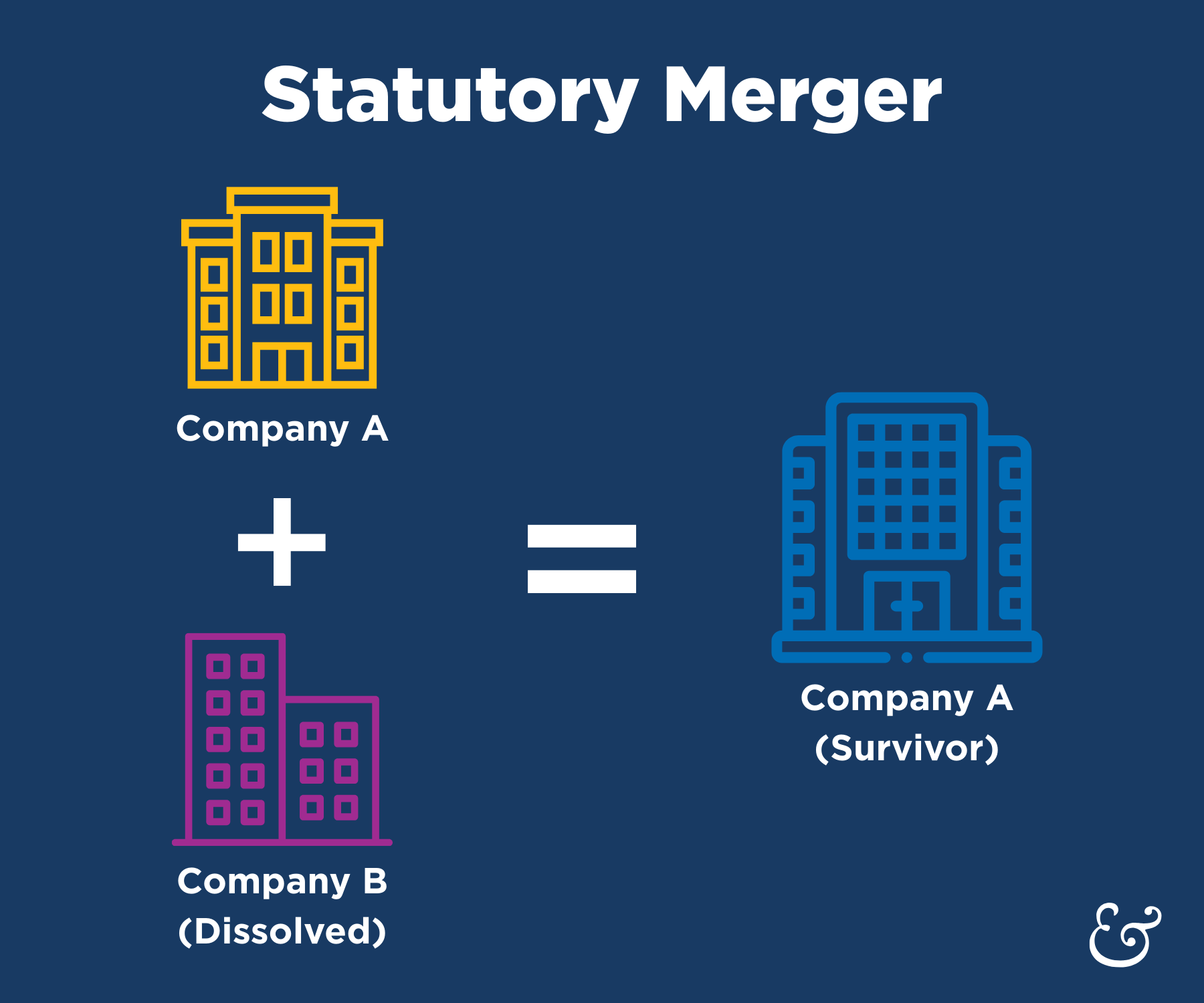

Statutory Merger

In a statutory merger, two or more legal entities combine into a single entity. The surviving entity is considered the successor while the merged entities are legally dissolved and no longer exist.

Mergers are typically the result of an acquisition or internal reorganization.

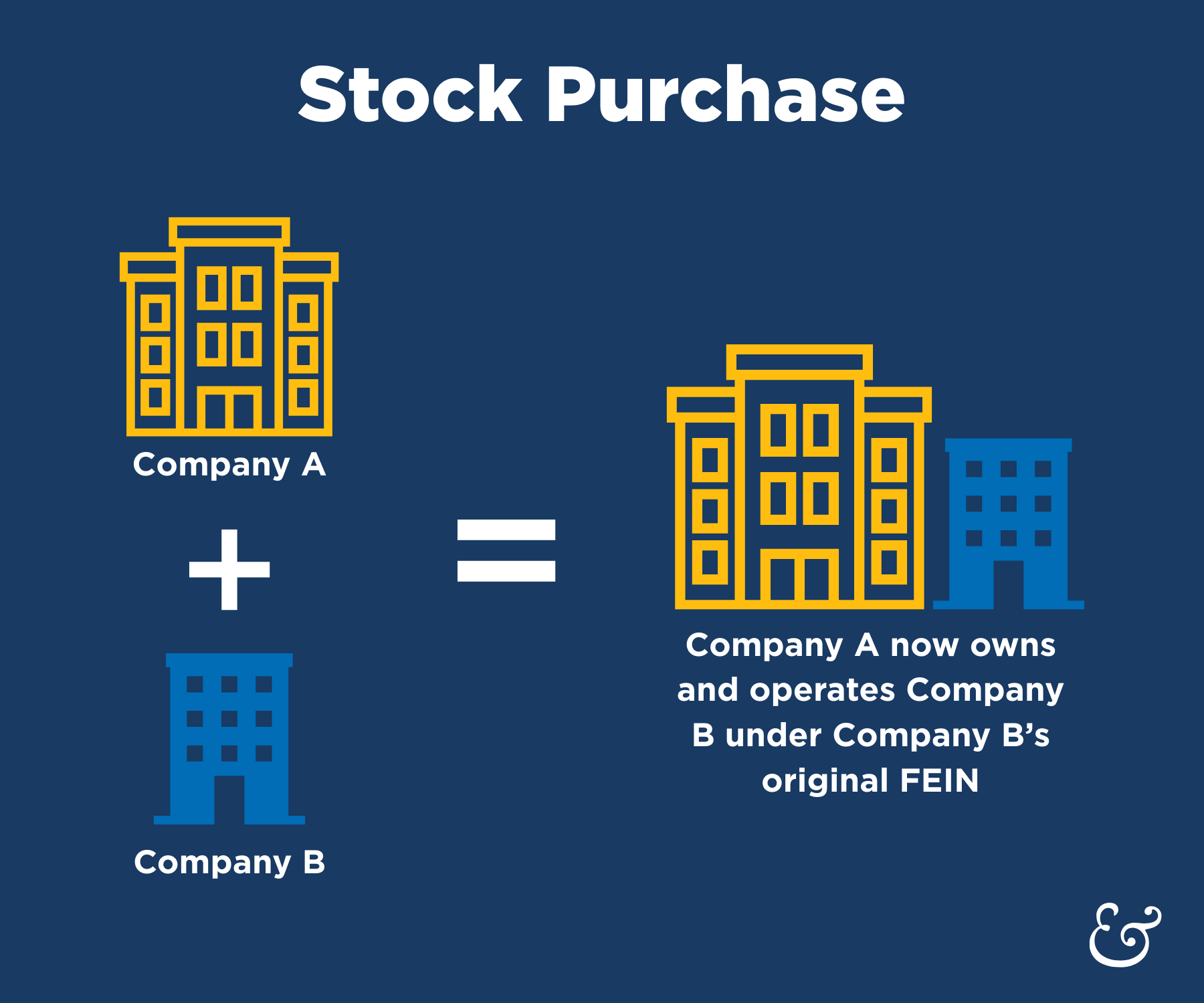

Stock Purchase

A stock purchase generally occurs when a Buyer acquires the ownership shares of a company. The Buyer takes over the entire business entity including assets, liabilities, and employees. The entity remains intact so there is no change in the Federal Employer Identification Number (FEIN) and no movement of the assets due to the acquisition.

Asset Purchase

Alternatively, an asset purchase occurs when a Buyer purchases substantially all or a portion of assets and/or certain liabilities from another business including the workforce. However, in an asset purchase, the Seller retains ownership of the legal entity, and the Buyer forms their own entity or uses an existing one to transfer the assets/workforce.

Internal Reorganization/Restructure

An internal reorganization or restructuring occurs when a business changes its internal structure while maintaining the same ownership. There are various business reasons why an internal reorganization may be made, including rearranging parts of the company (legal entities merging or separating them), departments, business units, etc. to make it better aligned with its goals, to make it more efficient, compliant, etc. Regardless of the reasoning – or how the company is restructured – it is still under the same ownership.

While an internal reorganization does not result in a change of ownership, there are still tax implications and important actions that must be taken in order to remain compliant. Most states treat internal reorganizations as predecessor-successor relationships, and they typically require the SUI experience (tax rate) of the predecessor to transfer to the successor.

The key difference between an internal reorganization and an outside acquisition is that internal reorganizations generally involve common ownership, whereas outside acquisitions do not. If there is no supporting legal documentation and/or assets transferred (besides employees), certain agencies will deny transfers of experience between commonly owned accounts and mandate that the predecessor remain active to continue to report and pay SUI wages and taxes, respectively.

Other Considerations

Total vs Partial Acquisitions

Acquisitions can be categorized as either partial or total based on the percentage of ownership acquired.

Partial Acquisition

Only a portion of a company is acquired, potentially including but not limited to specific business unit(s), division(s), etc. The remainder of the company is retained by the original owners.

Total Acquisition

A company is acquired in its entirety.

The Substantially All Rule

The definition of a partial/total acquisition varies from state to state. In many states, the “substantially all” rule indicates that at a certain percentage, a partial transfer becomes a total transfer. For example, in Colorado, if a Buyer acquires more than 90% of the entity, it is considered a total transfer.

It is important to note whether an acquisition is partial or total as it will have implications and additional relevant actions necessary depending on its categorization.

Depending on the type of transfer, there may be additional information and documentation required as part of the transfer paperwork. Partial transfers will require additional details such as employee level historical data to complete the transfers. When total transfers occur and no employees remain under the predecessor FEIN, related tax accounts (state unemployment insurance, local income tax, paid family medical leave, and other payroll related taxes) should be inactivated.

Transaction Timing

The timing of a transaction will impact when the state transfers the SUI experience from the predecessor to the successor’s account. The effective date of the acquisition can influence how and when the state applies the predecessor’s experience which may result in financial implications for the successor.

For instance, if a transfer effective date is 12/31, an agency may combine predecessor and successor rate experience as of 1/1 (the next day). However, if a transfer effective date is 1/1, an agency may combine the rate experience as of 4/1 (the next quarter) or 1/1 of the following calendar year.

For the sake of consistency and compliance reporting, the effective date displayed on any legal or internal documentation in support of an acquisition, merger, reorganization, etc. should be reconciled with the date in which the employees were transferred from the predecessor to successor.

Reporting

Regardless of the type, timing, or reason for a transaction, state unemployment workforce agencies require these transactions to be disclosed. Failure to understand the nuances within merger and acquisition activity and necessary actions can lead to costly compliance issues and negative experiences for your employees.

Don’t be caught unaware, trust Thomas & Company to be your partner, guiding you with expertise and dedication every step of the way. Thomas & Company can walk you through the process to ensure that no steps are missed, take on the burden of completing the required paperwork, and review the acquisition activity to help mitigate potential tax liabilities.

Questions to Ask

It is important to ask the right questions in order to help your organization take the appropriate actions and ensure compliance throughout the transaction process.

How Does This Impact My Organization as a Whole?

Beyond statutory compliance and its importance for the long-term financial well-being of your organization, mergers and acquisitions can have major implications throughout your organization, impacting countless departments and processes.

Don’t forget to check back in over the coming weeks as we continue to analyze how mergers and acquisitions impact all facets of your organization, including:

- Multi-State Compliance

- Employment and Wage Verification

- Unemployment Cost Management

- Tax Credits & Incentives

- Offboarding Compliance (State Separation Notices)

- I-9

Your Trusted Partner in Merger & Acquisition Compliance

Not sure where to start? At Thomas & Company, we know that merger and acquisition compliance is complex and can be confusing – especially if you don’t live it day in and day out like we do. That’s why we are here to help!

Our dedicated team of M&A experts understands the nuanced dynamics of these transformative deals. With 100+ years of experience and an eye for detail, we are ready to work with your team to maximize the value and potential of your business transaction(s). Our approach is tailored to align with your unique business needs, ensuring that each transaction enables your company’s success.

Contact us to learn more about how Thomas & Company can enable your success!